Abstract

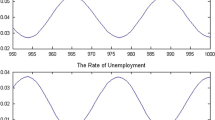

We investigate the relationship between productivity and unemployment with an ABM approach. In particular, we use the framework of Riccetti et al. (J Econ Interact Coord 10(2):305–332, 2015) to run computer simulations considering different levels of productivity and analyse the corresponding effects on unemployment. The simulation results show the emergence of a fluctuating pattern of the unemployment rate, the public deficit and the inflation rate as functions of productivity. The marked pattern of the unemployment rate in the model is empirically validated by the OECD database. This unexpected oscillating behaviour remains in subsequent simplifications of the baseline model. Thus, our approach allows us to explain the productivity–employment linkage as an emergent macroeconomic property of a complex system. We conclude that economic policies aimed at increasing labour productivity could have unintended side effects on the unemployment rate, the government deficit and the inflation rate, which should be explored and taken into account before the policy is implemented.

Similar content being viewed by others

Notes

We consider yearly data from the OECD for different countries. In the OECD database (https://data.oecd.org/), labour productivity is calculated by the ratio between GDP (measured in USD constant prices using 2010 as the base year) and the total number of hours worked, taking the normalized value 100 at 2010.

In https://archive.org/details/ProductivityAndUnemploymentForOCDECountries, data and graphs are shown for a more extensive set of countries than those presented in Fig. 1.

A first draft of this paper was published in 2012 (MPRA Paper from University Library of Munich, Germany).

We are interested in finding reduced versions of the Riccetti–Russo–Gallegati model that preserve the oscillating pattern and so allow us to study the relationship between productivity and (un)employment. However, other results produced by the full model (from financial contagion to large crises) could be not reproduced by these simpler versions.

The emergence of damped oscillations may be related to the property of self-organized criticality, typically observed in complex systems that exhibit the “sandpile effect”. In our model, low relative changes in productivity would be absorbed (with no impact) by the economy until they reached a critical value, after which they would then produce a significant influence on the process.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Assenza T, Colzani P, Delli Gatti D, Grazzini J, J. (2018) Does fiscal policy matter? Tax, transfer, and spend in a macro ABM with capital and credit. Ind Corp Change 27(6):1069–1090

Atolia M, Chatterjee S, Turnovsky SJ (2012) Growth and Inequality: dependence on the time path of productivity increases (and other structural changes). J Econ Dyn Control 36(3):331–348

Bookstaber R, Paddrik M, Tivnan B (2018) An agent-based model for financial vulnerability. J Econ Interact Coord 13(2):433–466

Darity WA, Goldsmith AH (1996) Social psychology, unemployment and macroeconomics. J Econ Perspect 10(1):121–140

Dawid H, Neugart M (2011) Agent-based models for economic policy design. East Econ J 37(1):44–50

Dehghanpour K, Nehrir MH, Sheppard JW, Kelly NC (2018) Agent-based modeling of retail electrical energy markets with demand response. IEEE Trans Smart Grid 9(4):3465–3475

Deissenberg C, van der Hoog S, Dawid H (2008) EURACE: a massively parallel agent-based model of the European economy. Appl Math Comput 204:541–552

Dosi G, Fagiolo G, Roventini A, A. (2006) An evolutionary model of endogenous business cycles. Comput Econ 27(1):3–34

Farmer JD, Foley D (2009) The economy needs agent-based modelling. Nature 460(7256):685

Fatas-Villafranca F, Fernández-Márquez CM, Vázquez FJ (2019) Consumer social learning and industrial dynamics. Econ Innov New Technol 28(2):119–141

Giri F, Riccetti L, Russo A, Gallegati M (2019) Monetary policy and large crises in a financial accelerator agent-based model. J Econ Behav Organ 157:42–58

Goldsmith AH, Veum JR, Darity W Jr (1996) The psychological impact of unemployment and joblessness. J Socio-Econ 25(3):333–358

Gros C (2008) Complex and adaptive dynamical systems. Springer, New York

Günther M, Stummer C (2018) Simulating the diffusion of competing multi-generation technologies: an agent-based model and its application to the consumer computer market in Germany. In: Fink A, Fügenschuh A, Geiger MJ (eds) Operations research proceedings 2016. Springer, New York, pp 569–574

Howitt P (2008) Macroeconomics with intelligent autonomous agents. In: Farmer REA (ed) Macroeconomics in the small and the large: essays on microfoundations, macroeconomic applications and economic history in Honor of Axel Leijonhufvud. Edward Elgar, Cheltenham, pp 157–177

Klein D, Marx J, Fischbach K (2018) Agent-based modeling in social science, history, and philosophy an introduction. Hist Soc Res 43(1):7–27

Leibenstein H (1966) Allocative efficiency vs. X-efficiency. Am Econ Rev 56(3):392–415

Leibenstein H (1975) Aspects of the X-efficiency theory of the firm. Bell J Econ 6(2):580–606

Leibenstein H (1978a) General X-efficiency theory and economic development. Oxford University Press, Oxford

Leibenstein H (1978b) On the basic proposition of X-efficiency theory. Am Econ Rev 68(2):328–332

Leibenstein H (1979) X-efficiency: From concept to theory. Challenge 22(4):13–22

Manuelli RE (2000) Technological change, the labor market and the stock market. In: NBER working paper 8022

Mas-Colell A, Whinston MD, Green JR (1995) Microeconomic theory. Oxford University Press, Oxford

Mazzocchetti A, Raberto M, Teglio A, Cincotti S (2018) Securitization and business cycle: an agent-based perspective. Ind Corp Change 27(6):1091–1121

O'Donoghue T, Somerville J (2018) Modeling risk aversion in economics. J Econ Persp 32(2):91–114

Pissarides CA (2000) Equilibrium unemployment theory. The MIT Press, New York

Pyka A, Fagiolo G (2007) Agent-based modelling: a methodology for neo-Schumpeterian economics. In: Hanusch H, Pyka A (eds) Elgar companion to neo-schumpeterian economics. Edward Elgar, Cheltenham, pp 467–487

Riccetti L, Russo A, Gallegati M (2013a) Financial regulation in an agent-based macroeconomomic model. In: MPRA paper, University Library of Munich, Germany

Riccetti L, Russo A, Gallegati M (2013) Unemployment benefits and financial leverage in an agent based macroeconomic model. Econ Open-Access, Open-Assessment E-Journal 7(42):1–44

Riccetti L, Russo A, Gallegati M (2015) An agent-based decentralized matching macroeconomic model. J Econ Interact Coord 10(2):305–332

Riccetti L, Russo A, Gallegati M (2016a) Financialisation and crisis in an agent based macroeconomic model. Econ Model 52:162–172

Riccetti L, Russo A, Gallegati M (2016b) Stock market dynamics, leveraged network-based financial accelerator and monetary policy. Int Rev Econ Finance 43:509–524

Riccetti L, Russo A, Gallegati M (2018) Financial regulation and endogenous macroeconomic crises. Macroecon Dyn 22(4):896–930

Rixen M, Weigand J (2014) Agent-based simulation of policy induced diffusion of smart meters. Technol Forecast Soc Change 85:153–167

Russo A, Riccetti L, Gallegati M (2014) Growing inequality, financial fragility, and macroeconomic dynamics: an agent-based model. In: Kamiński B, Koloch G (eds) Advances in social simulation. Springer, New York, pp 167–176

Russo A, Riccetti L, Gallegati M (2016) Increasing inequality, consumer credit and financial fragility in an agent based macroeconomic model. J Evol Econ 26(1):25–47

Russo A (2017) An agent based macroeconomic model with social classes and endogenous crises. Italian Econ J 3(3):285–306

Silvestre J, Araújo T, Aubyn MS (2019) Individual satisfaction and economic growth in an agent-based economy. Comput Econ 54(3):893–903

Seppecher P, Salle IL, Lavoie M (2018) What drives markups? Evolutionary pricing in an agent-based stock-flow consistent macroeconomic model. Ind Corp Change 27(6):1045–1067

Stigler GJ (1976) The Xistence of X-efficiency. Am Econ Rev 66(1):213–216

Tesfatsion L (2001) Introduction to the special issue on agent-based computational economics. J Econ Dyn Control 25(3–4):281–293

Tesfatsion L (2002) Agent-based computational economics: Growing economies from the bottom up. Artif Life 8(1):55–82

Acknowledgements

The authors would like to thank “Centro de Computación Científica” at UAM where the simulations were carried out.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Fernández-Márquez, C.M., Fuentes, M., Martínez, J.J. et al. Productivity and unemployment: an ABM approach. J Econ Interact Coord 16, 133–151 (2021). https://doi.org/10.1007/s11403-020-00287-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-020-00287-1